The Agricultural Marketing Service (AMS) of USDA published the annual notice setting rates for grain inspection and weighing services under the U.S. Grain Standards Act (USGSA) for the 2025–2026 period. The Federal Register notice formalizes the cost-recovery fees that underpin inspection, weighing, and related services used throughout export and domestic grain supply chains.

The AMS rates typically reflect updated cost-recovery calculations and are applied by Federal Grain Inspection Service (FGIS) delegations and Federal-state inspection programs that perform official inspections and weighing’s for exporters, processors, and warehouse operators.

Operational implications are immediate for commercial contracts and scheduling. Exporters should expect adjustments to per-lot inspection charges, container or barge weighing fees, and certificate issuance costs; domestic handlers should review throughput related charges that can scale with volume. Where inspection is a pass-through cost in sales contracts, commercial terms may need prompt revision to avoid margin erosion.

National and Regional Fee Updates

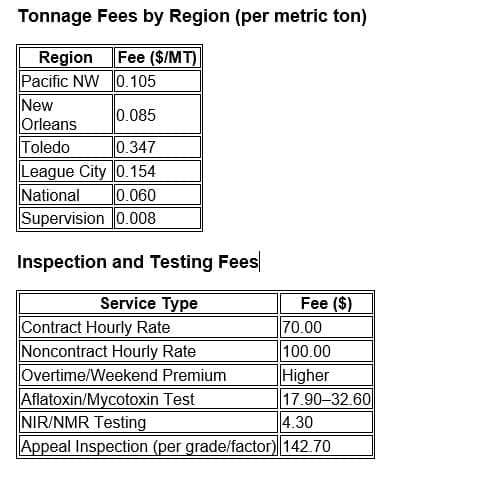

AMS has standardized several categories of fees, while still allowing for localized rates in high-volume export regions. Key national rates include:

- Inspection and weighing services: $70/hour for contract services and $100/hour for noncontract work, with premiums for nights, weekends, and holidays.

- Laboratory testing: Aflatoxin and mycotoxin testing now range from $17.90 to $32.60 per sample. Near-infrared (NIR) and nuclear magnetic resonance (NMR) testing are $4.30 per sample.

- Appeals: Appeals and board appeals are priced at $142.70 per grade or factor evaluated.

Regional tonnage fees reveal notable cost differentials:

- Pacific Northwest (PNW): $0.105/MT

- New Orleans: $0.085/MT

- Toledo: $0.347/MT

- League City: $0.154/MT

- National tonnage fee: $0.060/MT

- Supervision fee: $0.008/MT

The notice provides the official rate schedules and legal basis under the USGSA; companies performing or relying on official inspection services should retain the published schedules for audit and reconciliation. Where disputes arise over invoiced inspection fees, the Federal Register notice is the controlling published authority and should be referenced in communications with inspection providers and carriers.