Background

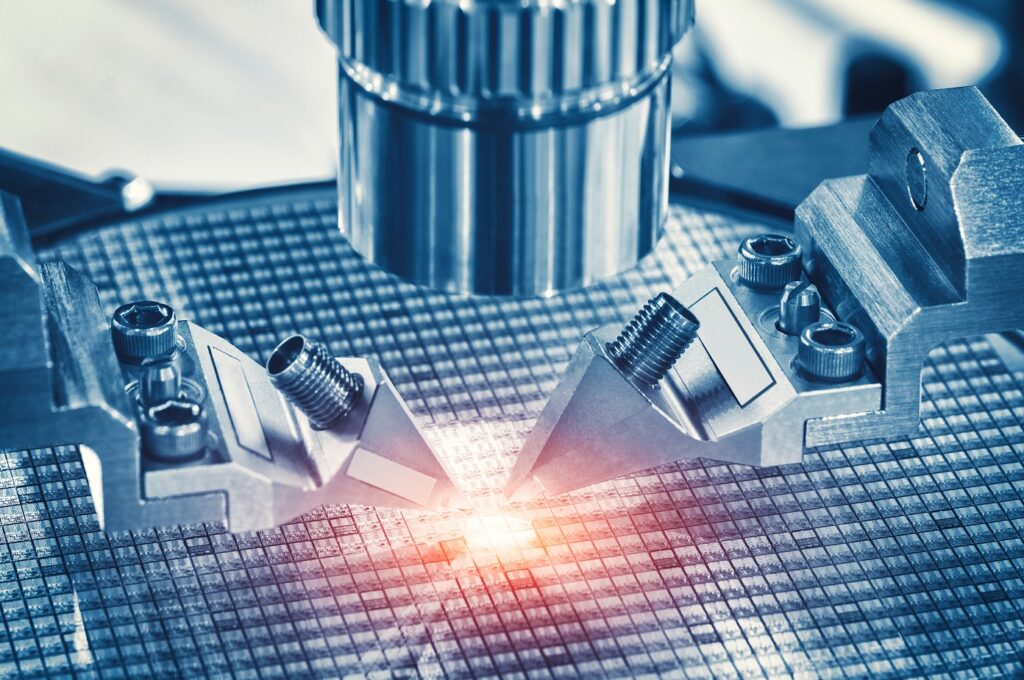

In the early 2000s, importers of complex flat panel display production equipment, semiconductor production equipment, and subcomponent pieces were limited in how they could have their products classified due to the emerging technologies and lagging Harmonized Tariff System categories of the time. This exposed importers higher duties and unnecessary compliance risks.

The Problem

The review for how these machines were being classified exposed that every piece of equipment and even their subcomponents could be classified under multiple different headings and at varying duties. Without a clear classification framework, companies importing these items faced significant challenges:

• Inconsistent classifications resulting in varying duty levels and higher landed costs

• Customs authorities around the world applying inconsistent rules that created trade barriers and uncertainty

• Loss of competitiveness resulting from the additional and inconsistent duties

The Solution

One of the leading manufacturers of semiconductor and flat panel equipment tasked Alba with creating a solution. After the review, Alba drafted a proposal to introduce an entirely new HS heading (8486) that would pull all semiconductor and flat panel display machines into a single category. This involved:

• Drafting new legal notes: Including the development of legal note 9(D) to Chapter 84 (now note 11(D)), which clarified that machines meeting the description of heading 8486 were to be classified solely under this heading

• Creating supporting Explanatory Notes to provide customs authorities with detailed guidance on classifications

• Designing new subheadings: Specifically identifying instruments and apparatus for measuring or checking semiconductors and flat panel displays, previously scattered across headings 9030 and 9031.

The Outcome

By establishing heading 8486, Alba created a single, duty-free classification for these machines and many of their subcomponents. Importers benefited significantly as their equipment now had a simplified classification process under a duty-free heading. The duty savings alone for the industry are easily in the hundreds of millions of dollars.

Just as importantly, the rewrite eliminated the uncertainty that had plagued the industry. There was no longer an issue of inconsistent treatment at the border or unexpected duty bills. Classification gained clarity and predictability, and importers gained a significant competitive edge in the global marketplace.