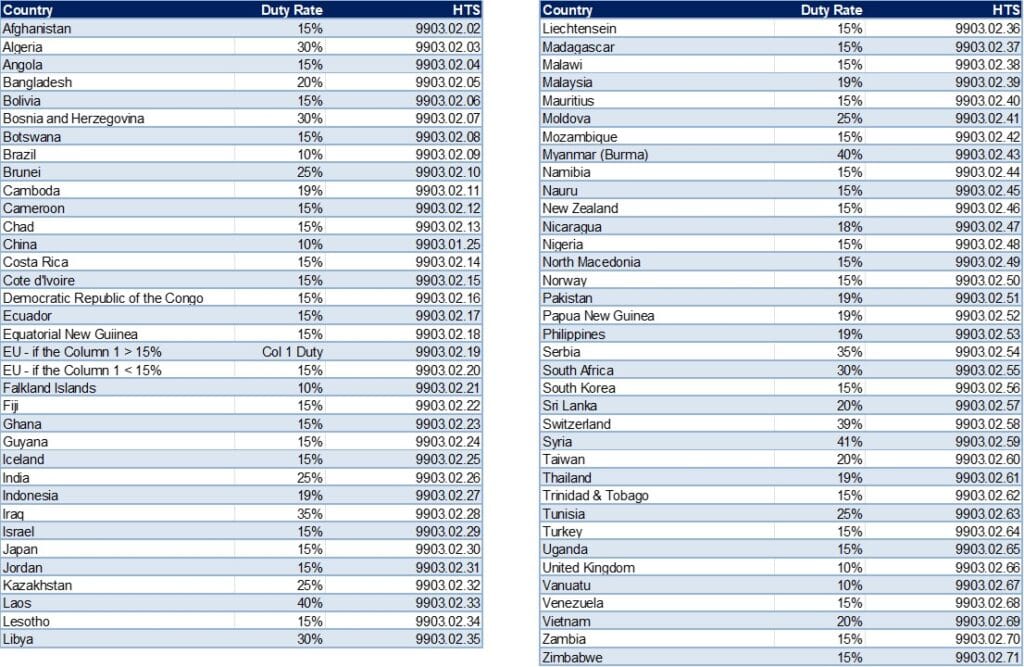

The Trump Administration issued updated reciprocal tariff rates yesterday that will take effect as of August 7th. Unless listed in the table above, which includes information from the original Annex I of the Executive Order on this topic, the reciprocal tariff rate is 10%.

The original Executive Order for this communications is here.

There are some commodity and situational exceptions to these rates consolidated under Annex II, here.

Goods that depart port within seven days of August 1st, 2025, and arrive to the US and are cleared by Customs & Border Protection by October 5th, 2025 will avoid the new reciprocal rates.

Canada-Specific Tariff

A further Executive Order related specifically to trade with Canada applies an ad valorem rate of duty of 35% on certain Canadian products, and 10% on certain Canadian energy or energy resources imported into the USA – applicable as of 12:01 ET on August 1st, 2025. Additional tariffs under IEEPA will stack onto these ad valorem levels. Items covered by the USMCA are excluded from these rates.

Mexico-Deadline Extension

Mexico has been granted an additional 90 days during which the US and Mexico will continue tariff rate discussions for products not covered by the USMCA.

China-Deadline is August 12th

As a reminder, China’s currently rate levels remain in place until August 12th as discussions between the two countries continue. Comments coming out of those discussions highlight the goal being to extend the August 12th deadline to grant more time to work on a more detailed solution.

Brazil-Specific Tariff

The White House issued an Executive Order declaring a national emergency related to the Government of Brazil earlier this week. As part of this action, a 40% additional duty will be imposed on designated Brazil-origin goods under the International Emergency Economic Powers Act (IEEPA). This additional duty stacks onto the 10% reciprocal tariff assigned to Brazil in the table above.

The End of the De Minimis Exemption – August 29th

One final communication today, so far, via Executive Order was the end of the de minimis exemption for commercial shipments. “Imported goods sent through means other than the international postal network that are valued at or under $800 and that would otherwise qualify for the de minimis exemption will be subject to all applicable duties,” the Executive Order said.

Goods shipped through the international postal system will be assessed one of the below duties:

- Ad valorem duty: A duty equal to the effective tariff rate imposed under the International Emergency Economic Powers Act (IEEPA) that is applicable to the country of origin of the product. This duty shall be assessed on the value of each package

- Specific duty: A duty ranging from $80 per item to $200 per item, depending on the effective IEEPA tariff rate applicable to the country of origin of the product. The specific duty methodology will be available for six months, after which all applicable shipments must comply with the ad valorem duty methodology

Individuals can still bring in up to $200 of purchased merchandise and $100 in gifts, the communication said. Read the full EO here.

We are here to help – if you have questions on rates for your products, please contact us or your local Alba office.